|

Tax Perspectives

Please note that these publications may not be up-to-date as taxation matters are subject to frequent changes.

PDF Format

Issue Contents Issue Contents

All Issues All Issues

Winter 2008

Volume 8, Number 2

The information in Tax Perspectives is prepared for general interest only. Every effort has been made to ensure that the contents are accurate. However, professional advice should always be obtained before acting and TSG member firms cannot assume any liability for persons who act on the basis of information contained herein without professional advice.

Securing the Equity in Your Business

By Nancy Yan, MBA, CA

Cadesky and Associates LLP (Toronto)

Businesses require working capital. The cheapest source of working capital is internally-generated profits, so we frequently see businesses self-finance. While this is smart from a financial perspective, if hard times hit the owners will find that their equity stands last in line, behind the bank, other secured and preferred creditors, and trade creditors.

Securing the equity in a business is not complex. It takes several steps, and some legal documentation.

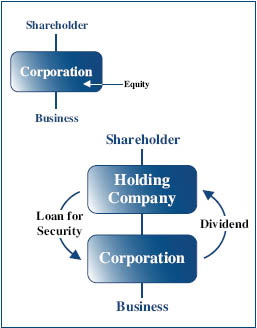

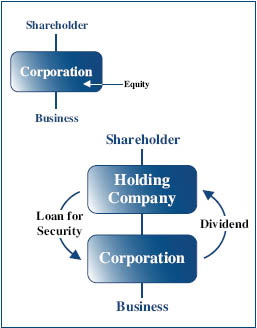

The process, in its simplest form, involves paying out the equity of the business as a dividend. To avoid paying personal tax, a holding company should be put in place to receive the dividend. Then the funds may be loaned back and security taken on the assets of the business. The security should be registered in the appropriate way (which may involve a provincial filing, normally handled by legal counsel).

Some security registrations require renewal. It is prudent to review all such registrations regularly, to make sure that they remain in good standing.

There are restrictions on paying a dividend if the company will thereby be rendered insolvent. If the restrictions are not heeded, the directors may be personally liable to the creditors in a future insolvency. Directors should also be aware of the spectre of personal liability for unremitted source deductions and GST.

|

|