PDF Format

Issue Contents Issue Contents

All Issues All Issues

Spring 2010

Volume 10, Number 1

The information in Tax Perspectives is prepared for general interest only. Every effort has been made to ensure that the contents are accurate. However, professional advice should always be obtained before acting and TSG member firms cannot assume any liability for persons who act on the basis of information contained herein without professional advice.

The Benefits of a Representative Office in China

By P.Y. Ng, ACCA

Thomas Lee & Partners (Hong Kong)

By Grace Chow, CA, TEP

Cadesky and Associates LLP (Toronto)

Many Canadian businesses importing goods from China find it necessary to have local personnel on the ground to assist with purchasing, logistics, quality control, supplies procurement and whatever other issues that may arise in China. Very often, these people appear to be independent representatives or buying agencies who provide such services for a fee. In practice, however, they may well be employees and their offices may, in substance, be those of the Canadian importer.

This can lead to problems, as such activities could be deemed to constitute a permanent establishment in China, and one that has not been declared to the Chinese authorities. Aside from the tax implications, which can be onerous, the Chinese government may also determine that the activities are, in fact, illegal because the Canadian company has not applied for and received the required permits.

Simple Solution

There is a simple solution to this matter: establish a China representative office. The premises would be leased in the name of that representative office and the China personnel would become its employees.

As with most things in China, there is an application process for obtaining the license for such a representative office. This process is, however, much more streamlined than the one for establishing a corporation in China. For example, it does not require a business plan, or a minimum capital commitment, which for corporations can often be substantial.

The China representative office must limit its activities to acting as a representative for the Canadian company in purchasing, logistics, quality control, inspection, liaison and related services. It cannot buy and sell goods, or do business in the China domestic market. Basically, it assumes the role of a buying agent.

The basic corporate tax rate in China is now 25%. Unfortunately, gone are the days of tax exemptions and reduced income tax rates, special economic zones with particular tax incentives, and tax rebates where profits were re-invested in China activities. Instead, the tax system has been simplified and standardized.

Special Status

The China representative office is given special status for tax purposes. Instead of having to calculate its profits according to transfer pricing rules, it may consider its profits simply to be 25% of its expenses. These expenses exclude the purchase of goods, which a China representative office is not allowed to do in any case. Taxes paid in China can, therefore, be quite low.

If the China representative office is merely a branch of a Canadian corporation, its profits will be taxable in Canada. And, if the Canadian corporation pays its China branch a buying commission, that expense can't be deducted for tax purposes, as it is considered a payment from one division to another of the same entity.

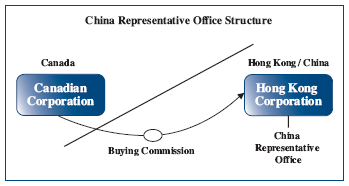

If the Canadian corporation wants that payment to be tax deductible, a foreign corporation needs to operate the China representative office. In effect, the China representative office would become a branch of that foreign corporation. A Hong Kong corporation would be the logical choice for playing that role because of Hong Kong's proximity to China, its favourable tax system and because Hong Kong and China are now considered to be the same country.

The China representative office should receive compensation commensurate with the services it provides. For example, if it acts as a buying agent, it should receive a buying commission. The amount of the buying commission must be reasonable under the circumstances, and this will require an analysis of the activities involved, risks assumed and other factors. If the buying commission seems too high, the CRA may question the deductibility of the expense to the Canadian corporation, and could potentially apply penalties as well as attribute income to the shareholders. But a reasonable buying commission will be deductible to the Canadian corporation and the tax the Hong Kong corporation would pay on that commission will be nominal.

Many Advantages

Canadian companies purchasing goods in China should consider establishing a China representative office to organize the activities required to support that effort. This can have a number of advantages, both from a business and a tax perspective.

Through our international associates based in Hong Kong and China, we can assist with every aspect of setting up a China representative office, including the incorporation of a Hong Kong company, and obtaining the necessary licenses in China.

|