PDF Format

Issue Contents Issue Contents

All Issues All Issues

Spring 2010

Volume 10, Number 1

The information in Tax Perspectives is prepared for general interest only. Every effort has been made to ensure that the contents are accurate. However, professional advice should always be obtained before acting and TSG member firms cannot assume any liability for persons who act on the basis of information contained herein without professional advice.

Falling Corporate Tax Rates

In the fall of 2007, Canada's Department of Finance introduced its long-term plan to reduce the combined federal and provincial corporate tax rate to 25% by 2012, calling on the provinces to reduce their corporate tax rates to 10%. Since then, most provinces have answered that call and, as a result, Canada is poised to have the lowest tax rate among the G7 by 2012. Most significantly, it will be 10% to 15% below the U.S. corporate tax rate.

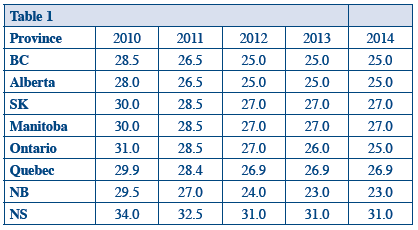

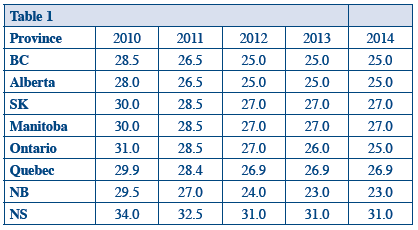

Table 1 below shows the combined corporate tax rates for selected provinces (by calendar year):

In addition to declining corporate tax rates, the introduction of the eligible dividend regime, which went into effect January 1, 2006, improved tax integration for high-rate corporate income (tax integration ensures that the tax paid on corporate income and the personal tax paid by the shareholder on receiving dividends are roughly the same as tax that would apply if the income was earned personally). Eligible dividends, generally paid from income taxed at the general corporate tax rate, are subject to a preferential personal tax rate compared to non-eligible dividends. Non-eligible dividends are generally paid from after-tax income taxed at the lower small business rate or from investment income. Prior to the eligible dividend regime, all dividends were effectively subject to the same marginal personal tax rate.

Dividend or Bonus — Does it Matter?

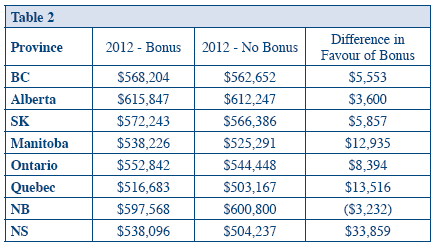

As a result of better integration, owner-managers in most provinces should not care whether they receive a dividend versus a bonus. For example, suppose a corporation earns $1,000,000 of taxable income to be paid to the owner-manager. The first option (the "Bonus" option) is to pay the owner-manager a bonus of $500,000 to bring the income down to the Small Business Limit ($500,000 federally and in most provinces) and extract the remaining surplus as a non-eligible dividend. The objective of this common strategy is to have corporate income up to the Small Business Limit taxed at the small business rate, which is between 11% and 19%, depending on the province. The second option (the "No Bonus" option) is not to pay a bonus, but rather to pay the lower rate of tax on the first $500,000 of corporate profits and the high rate of corporate tax on the next $500,000. The after-tax corporate surplus would then be extracted using a combination of eligible and non-eligible dividends.

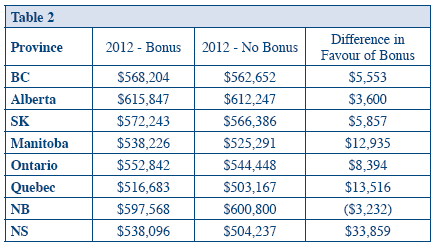

Table 2 shows, by province, the after-tax personal cash received on $1,000,000 of corporate income using the "Bonus" and "No Bonus" options in 2012:

As shown, the difference in favour of the "Bonus" option is relatively small (around 1% or less), except in Nova Scotia, where the corporate tax rate is higher than in the other provinces (see Table 1).

No Need for Funds

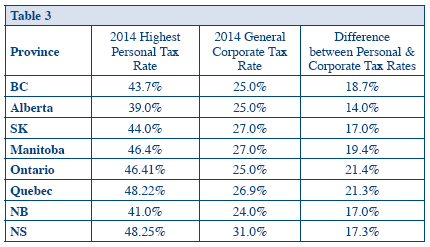

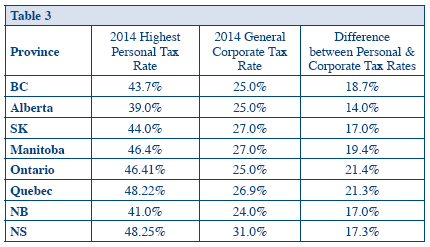

What if the owner-manager has no immediate need for funds? Some advisors have suggested that paying a bonus down to the Small Business Limit still provides a higher after-tax amount than retaining the cash in the corporation (the "Retain" option). The drawback of the "Bonus" option is that it results in prepaying tax if the funds are not needed because of the difference between the highest marginal personal tax rate (46% in Ontario, for example) and the general corporate tax rate in each province (25% in Ontario in 2014).

Table 3 shows the highest marginal personal tax rate (federal and provincial) for 2014 compared to the general corporate tax rate (federal and provincial) for 2014 in the following provinces:

This clearly shows the advantage to retaining funds in the corporation if the shareholder has no immediate need for them.

The drawback of the "Retain" option is that funds eventually paid to the owner-manager by way of dividends will be subject to higher overall taxes than if the "Bonus" option were used. But the benefits may still outweigh this drawback.

Note also that the personal tax rate on eligible dividends will increase from 2009 to 2011. Therefore, under the "Retain" option, the owner-manager will forego lower eligible dividend tax rates from 2009 to 2011 in favour of retaining funds within the corporation.

Rethink Results

Finally, given the sharp declines in corporate tax rates and the new eligible dividend regime, old rules of thumb involving business asset sales versus share sales will need to be revisited. While the old rule was that a vendor would generally prefer a share sale (because only half of the resulting capital gain would be taxable), today's mathematics are not as skewed in favour of such a sale. One needs to carefully review each fact pattern before deciding which option to choose.

|